Are you interested in entering the property market as an investor or owner/occupier but just can’t seem to get the figures to add up?

Well, did you know that your credit card limit directly impacts on the amount you can borrow for your mortgage?

What many borrowers don’t realise is that lenders don’t just look at the outstanding balances of your credit cards and what your monthly repayments are on those balances, but in fact they look at what your total repayments would be if you took your debt to the credit card limits. Their rationale is that you have the capacity to incur the total amount of that limit, so they must take this into account when determining your repayment serviceability.

How much could that impact your borrowing capacity if you are trying to purchase a property?

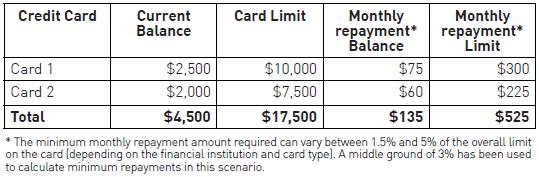

Let’s look at the following scenario.

The lender will calculate your minimum monthly repayments on the maximum $17,500 credit limit, equating to $525 per month, NOT the $4,500 balance, which only equates to monthly repayments of $135 per month. This is a difference of $390 per month that could be used as borrowing capacity towards the repayment of your new property loan.

Of course, the greater number of cards you have and the higher the total credit card limit you have, the greater this will impact on your borrowing capacity.

This could be the difference between achieving or not achieving your property dreams.

What can you do?

1. Consolidate your credit card debt and cancel unnecessary credit cards. This will reduce your monthly interest repayments and free up your income for other repayments. Do you really need more than one credit card if it is directly impacting your borrowing capacity?

2. Reduce the limit of your cards to the minimum practical amount for your personal situation.

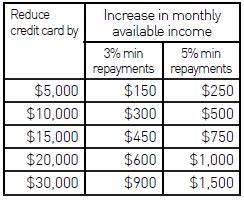

The impact of reducing your credit card limit

This table shows the impact on your monthly repayments by reducing your credit card limit.

This income can now be considered by lenders as available income that can be applied to your mortgage repayments, thus boosting your borrowing power and taking you one step closer to fulfilling your property dreams.